Price's Law (why wealth centers and more)

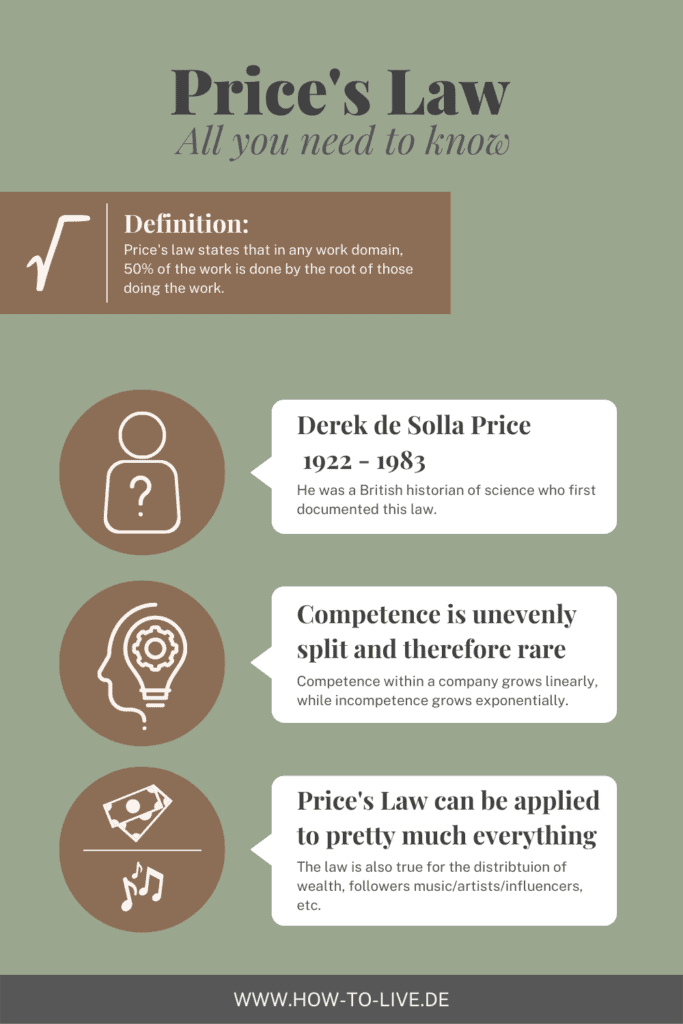

Derek de Solla Price was a British historian of science who made some groundbreaking observations. In this article we will focus on his most famous observation: The Price's law. This states that in each work domain 50% of the work is done by the root of the workers.

At first glance, this sounds much more complicated than it actually is. The root (meaning the mathematical root) of employees, in any socio-economic domain, performs 50% of the work done. In a business with 9 employees, 3 workers perform 50% of the work, in a business with 100 employees, 10 employees perform 50% of the work, and in a business with 10,000 employees, 100 employees perform 50% of the work.

As you can quickly and easily see, this is a scaling problem. The larger a company is, the higher the unproductivity of a large portion of its employees. To put it more simply: Competence within a company grows linearly, while incompetence grows exponentially.

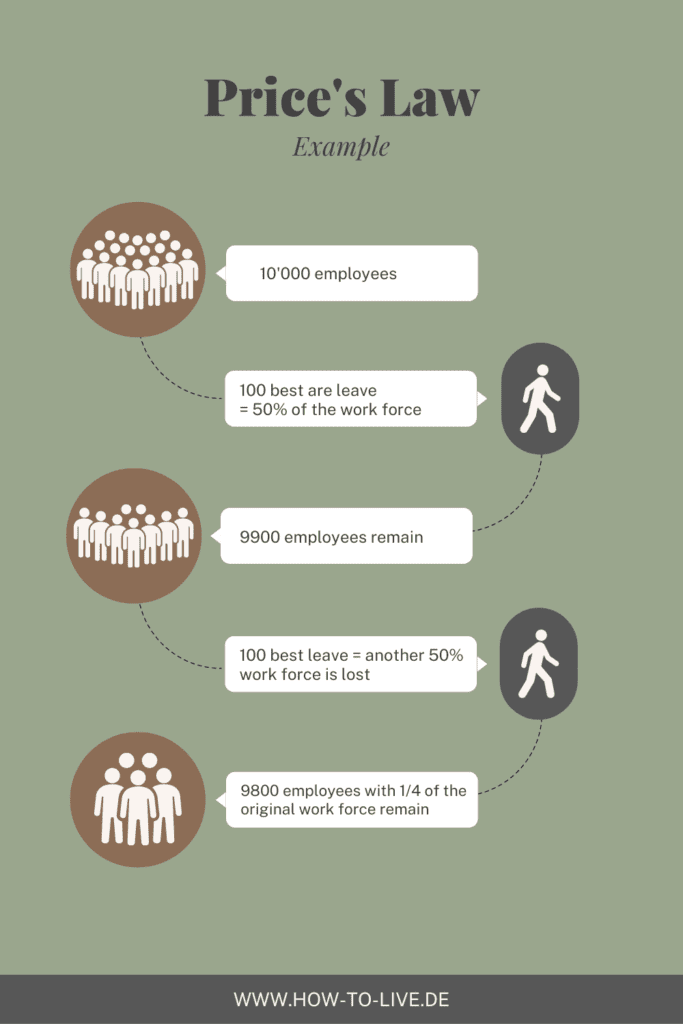

If a large company should ever falter, it can quickly happen that the competent employees who have the opportunity to work in another company leave. But if in a company with 10,000 employees the best 100 leave, and with them 50% of manpower or economic performance, then you now have 9,900 employees doing only 50% of the work. In other words, you have a bunch of incompetent employees who consume more money than they generate. If, as a result, you now have the most capable employees leaving again, you now have ~9,800 employees generating only 1/4 of the original economic output. This leads to spending way too much money on wages that are not worth the money.

The Price's law always takes effect when you play through a trade game or any distribution of goods to their end. Let's try to illustrate this in a simplified way by an example we all know:

When playing a round of Monopoly, all players start with the same amount of money and the same amount of goods, namely none. As the game progresses, some will get a little more money and buy more roads, houses and hotels, while others will lose piece by piece. The end of the game is usually that one or two of the players own the entire board and all the money, while everyone else goes away empty-handed.

Our economy, by and large, doesn't work much differently than a game of Monopoly, it's just significantly more complex.

You also constantly hear in the news or social media about the 1%, this denotes the richest percent of humanity, which has about 50% of the world's money. But it gets interesting here when we look at this 1% again in 1% and 99% split, because now again those who are in the 1% lie 50% of money. When we use this 1% again in 1% and 99% divide has again the 1% 50% of money. It is therefore a scalable principle.

In addition, the 1% is constantly changing. So it's rarely the same people for a long time in the Top One PercentOf course, there are exceptions, but as we all know, they only confirm the rule.

Really interesting on Price's law is that, although it was discovered in an economic context, it can be related not only to the economic performances in socio-economic hierarchies, but any distribution of anything. An example of this would be that the most famous five composers Bach, Mozart, Beethoven, Tchaikovsky and Brahms have produced 50% of classical music heard today. But that is not the end of the examples. Of all the music written by these five composers, 5% of the pieces occupy 50% of the total volume heard. So, as with economic performance, it is again a scalable principle.

The population figures of cities also fall under the Price's law: A small portion of all cities house 50% of the total population.

Even at the cosmic level it does not stop: a small part of all stars and planets, holds 50% of the total mass of all stars and planets.

However, since Derek Price based his law on economics, I would like to end with that as well:

The biggest problem with economic injustice is that we have no idea how to remedy it. It is impossible to get money from the 1% to take it, to distribute it to those who have hardly anything, without it going directly back to the 1% will flow back.

One reason for this is that everyone has certain basic needs. For example, food, drink, housing, electricity and so on. These costs must first be covered before people can start saving money.

Second, it's because those who have less don't manage their finances well (but I'm not suggesting that all people who have little have little because they manage their finances poorly). The decadence that is so often criticized about the wealthy, whether it's a yacht or a private jet, can also be seen in the less wealthy. Meanwhile, it's commonplace for lower-middle-class people to buy cars that are well out of their price range via credit.

Since most companies are run or owned by a few, this results in spending by the many going back into the pockets of the few.

But if we have no way to change the injustice in the world, what could we do? The problem is not the injustice of distribution in and of itself. The problem is that the few, who have most of the money, are not acting in the interests of the many. So if the distribution remains unjust, we should see that the money is used to build a better world. The few who have a lot have the responsibility to use the money in a way that benefits the most.

This can take the form of investments in renewable energy, better infrastructure, as well as social programs for those who have less. After all, it's harder to lose a well-functioning infrastructure that benefits everyone in a gamble than it is to give everyone a lump sum of money.

If, against all expectations, you do have an idea how to solve the problem of the unfair distribution of goods, a Nobel Prize could possibly await you, because just because something has never been done before does not mean that it is impossible.

Did you like this article? You can let us inform you about new articles: